by Mike Shallanberger | Jan 15, 2019

“I view my primary job as strengthening our talent pool.” — Jack Welch

No amount of coaching can offset poor hiring decisions, and the cost of a bad hire is estimated conservatively to be at least two or three times an employee’s annual salary plus thousands of dollars in lost opportunity cost for sales not made and for customers lost. The society for Human Resource Management (SHRM) estimates a hiring mistake could even cost as much as five times the employee’s annual salary.

The new reality in our industry is that we now have to get more sales from fewer people. It’s particularly crucial that you identify strategically critical jobs, and then invest your time and resources disproportionately to ensure that the right people, doing the right things, are in these positions. The more complex the sales or sales leadership task is, the bigger the performance gap between top and low performers.

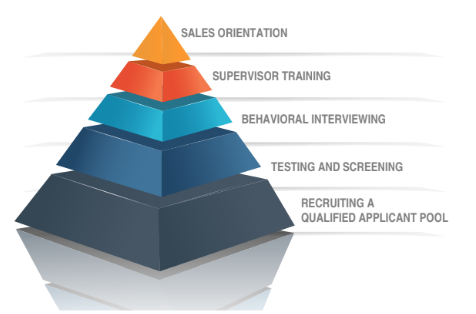

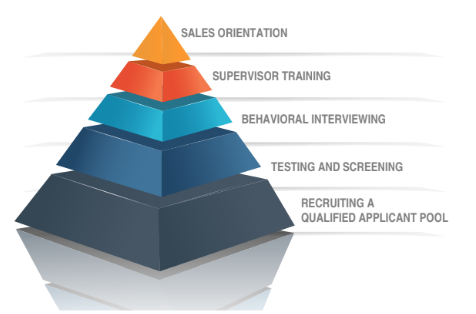

That’s why Schneider Sales Management has developed a five dimensional hiring process. It works like a funnel that starts with the hiring managers and ends with satisfied, productive employees who meet (or beat!) sales performance standards.

Starting at the bottom of the funnel and working up, the first stage of the five dimensional hiring process is continuous talent recruiting. To be successful at strengthening the sales staff, hiring managers need to recruit continuously, tailor their recruiting to target applicants (or, “fish where the fish are,” as the old adage goes), and build the applicant pool by selling the opportunity of working at your organization.

In the testing and screening stage of this process, hiring managers need to find the right tools to prescreen applicants quickly for fit to their sales roles, and find effective ways to maximize the impact of the first in-person interview. Once candidates have been tested and screened, they can be interviewed based on their personality traits and behaviors.

These behavioral interviews will focus interviews on required behavior and results and adhere to a structured interview guide. The interviewees’ answers during behavioral interviews should be compared to and measured against the job requirements, not to other candidates’ responses. There is a right and wrong way to interview, so make sure you’re adhering to legal standards during each candidate conversation.

After the selection process comes two of the most vital stages—stages that many financial institutions mistakenly consider separate from the hiring process.

Each new hire needs a strong sales orientation program and a conditional job offer with an onboarding plan in place. It’s important to outline expectations for new salespeople early on to avoid any confusion about the job role and to get them out of the starting blocks strong.

These tools together create hiring that can give banks and credit unions the quantum leap in performance that they need. Hiring mistakes are too expensive to make, and changing your hiring behaviors is an investment that your organization can make to improve your overall culture and revenue.

We’re the only firm in the industry that can help you put in place a process with these five dimensions. For more information on our support for hiring and HR managers, call us today at 303-221-4511.

by Mike Shallanberger | Dec 19, 2018

Will AI, in-branch, and self-help technology replace salespeople at banks and credit unions? The simple answer is NO according to a gathering of banking and tech thought leaders at the recent Future Branches conference in Austin, TX. But it will change how branch sales roles function, and add some key competencies required for salespeople.

While technology helps tremendously with understanding customer behavior, prospecting, and creating great customer journeys, there will always be a need for salespeople who can form and maintain relationships as a trusted advisor. No technology can build trust the way a great salesperson with keen emotional intelligence can. People are also needed to handle the sale of complex products, and to sell the benefits of new technology in order to drive adoption.

An article in the Harvard Business Journal suggests that, “Humans will need to focus on managing exceptions, tolerating ambiguity, using judgment, shaping the strategies and questions that machines will help enable and answer, and managing an increasingly complex web of relationships with employees and customers.”

For deeper conversations about how your bank or credit union hiring and sales practices may change as technology changes, sign up for the Schneider Report now.

by Mike Shallanberger | Dec 10, 2018

Coaching is just about every banker’s favorite buzzword. The problem is no one is actually doing it.

Sure, most managers check off their brief conversations with employees about “getting their numbers up” as a coaching conversation, but only a small fraction of bank managers are actually having conversations with their employees to give them specific guidance on how to get better at selling.

And who gets coached the least? Typically it’s new employees and top producers, the employees who want coaching the most and who will give you the best return on your investment in terms of increased sales production.

So what makes a great sales coach?

An average sales coach may occasionally conduct observation coaching with managers, but those sessions are often not specific and unfocused.

A great sales coach will record his or her observations of each employee’s use of preferred selling behavior on an observation notes form and give employees constructive, documented feedback based on those observations.

An average sales coach will use generalizations when categorizing sales behavior. A great sales coach will state his or her expectations for sales production, sales activity, and non-negotiable behavior to his or her direct reports in ways that the staff can restate clearly to others.

An average sales coach might hold sales meetings to develop employee skills in describing products’ features —but a great sales coach will create a peer coaching system that supports the company’s values and preferred way of selling.

Demonstrating preferred sales behavior is also a high priority of great sales coaches. Specific goals for sales managers like “Reduce my average time of talking per customer sales interview from 70% to 30%,” or “Make at least one statement of clear difference during every customer sales interview,” can help set the tone for each sales and service employee – and the sales culture in general.

Get your sales culture strong in 2019. Contact Schneider Sales Management, Inc. today for a consultation and conversation about how we can help you increase your revenue and improve your return on investment for each and every employee in your company. 303-221-4511

by Mike Shallanberger | Oct 15, 2018

The myth that the financial industry is more sophisticated than ever in selling is perpetuated by bankers at the nation’s very largest banks and credit unions.

They’re the primary tellers of their stories of sales and technological innovation at banking conferences, but most of their growth in sales has really been the result of their brand marketing clout and their ability to leverage big investments in data mining with target marketing, not the result of their skill at sales process or leading frontline employees in the sales effort.

The bottom line impact of allowing sales process and employee skills to atrophy is enormous. The sales reports we see show that sales per banker, referral sales, number of sales calls made, sales coaching observations, number of new customer onboarding calls made, and core product cross-sales are down throughout the industry. Many banks and credit unions are hitting growth goals through high-volume single-product transactional selling driven by targeted promotional offerings. To make matters worse, most of the targeted offers are at better-than-market pricing. In effect, the industry has reverted to buying low-margin transactional business.

So, what’s one step that can improve your sales by up to 30%?

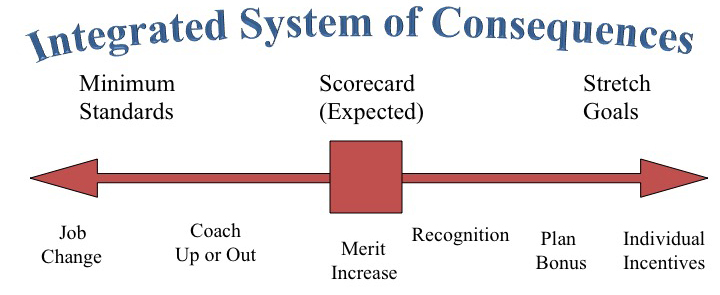

Simply put, improve your organization’s sales scorecards and goal setting methodology.

In most banks and credit unions sales goals are set at the top and divided among business units and branches based on recent history, and then divided among individual salespeople equally by job role without negotiation. Typically, every salesperson in a job role like personal banker will have the same or similar goals regardless of experience, competence, sales opportunity or competitive landscape. This is infinitely better than no goals at all, but clearly not the best approach based on our assessment work at over 1,400 bank and credit unions.

Here are the most common goal setting approaches ranked best to worst…

- A combination of team/unit goals and individual goals that are negotiated based on skills, experience and opportunity of the employee.

- All individual goals – negotiated

- All individual goals – dictated / assigned

- All team goals / unit goals

- Use of only short-term, promotional or sprint goals

- No goals at all.

Historically, cross-sales of core products, closed referrals and revenue per employee all run about 30% to 36% higher at institutions that use individual goals that are negotiated.

The psychological foundation of goals as a factor in motivation is that salespeople accept far more ownership in goals that are negotiated rather than assigned and in goals which they believe are achievable because they’ve participated in sales activity planning that requires them to think about how their goals could be achieved.

For decades, we’ve recommended to our clients that they implement a simple goal setting process based on 90-day action plans negotiated between individual salespeople and their sales leader. Each plan includes 3-5 annual goals, 3-5 objectives for the quarter, activities and strategies to accomplish the short-term objectives, and the selling behavior the employee will work to improve.

This process enables an organization to change priorities every quarter based on their current financial focus and gives every unite leader a point of focus for coaching and for objectively evaluating an employee’s contributions and recognizing top performers. Done well, it gives every employee a sense of purpose, accomplishment and motivation.

When scorecards and goal setting reflect the values of the organization and the importance of connecting deeply with customers and members, revenue follows. Every time.

Start the sales process right by hiring right. When you implement the Optimum Performance Profile, you’ll be able to immediately see the strengths and weaknesses of potential sales and service employees. Hire right, then support your sales people with goals and scorecards that help each employee become a master of sales.

by Mike Shallanberger | Oct 2, 2018

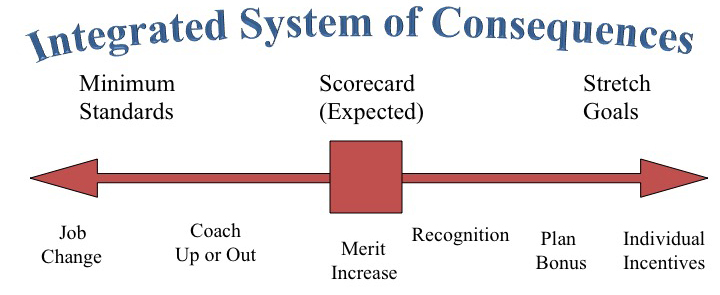

Give a child a cookie and you can get him to take a nap or clean his room. Behavior can definitely be influenced by rewards—something we never outgrow. But do sales incentives work? Unfortunately, bankers typically misuse incentive pay by choosing the wrong behavior to reward or by rewarding everyone regardless of discretionary effort. In most cases, results under incentive plans are the same as if we had simply managed and coached employees better…

Banks and credit unions fund sales incentive plans to get employees to do more. But more of what? Doing more of some activities and some sales production is actually counter-productive. Just ask any mortgage bankers who lost their shirt compensating lenders for overselling low-down payment loans, or branch managers who are seeing dozens of investment referral attempts with no closed business.

In some selling roles, bank incentive programs may not be cost effective and aren’t even terribly motivating. When we ask top producing tellers why they are making 100 referrals a month when most tellers only make 1 or 2, the answer isn’t the extra $5 they make on each referral. The answer is almost always that making 100 referrals per month will get them noticed, and if they get noticed they can get promoted.

Sales compensation is driven by employee scorecards and goals. If the scorecards are balanced or weighted properly, you’ll pay for the wrong results. If the goals are off, you either overcompensate employees or demotivate them. Surprisingly, we find that most banks and credit unions overpay their employees with incentive dollars by trying to pay everyone something instead of paying their best contributors more for the results that matter most.

To realize maximum value for your incentive payouts, pay only for sales above a goal level achievable by training and good supervision alone. Pay for behavior and outcomes that are profitable, within the employee’s control and associated directly with discretionary effort. Finally, pay disproportionately to top producers and supervisors who drive most of your production. At most financial institutions, 50% or more of incentive dollars go to average performers.

To encourage sales leaders to coach, pay them for achieving a specified percentage of employees meeting goals so they can’t rely on one or two employees to carry their team without coaching everyone. One of the most successful and sustainable incentive programs we’ve seen paid regional managers on two factors – the percentage of employees meeting and exceeding goal and the percentage of employees who met the requirements to be promoted to the next level.

Sign up for The Schneider Report below for free tips on how to increase your revenue, hire employees who can sell, and increase customer satisfaction.