by SchneiderSales | May 11, 2020

What bank or credit union CEO doesn’t think about cutting their training budget in the middle of an industry crisis that impacts earnings in a big way?

With big potential gains in market share at stake as we move into the upswing after the current crisis, sales training is the one category of training you can’t afford to cut. The opportunity cost in lost loans and deposits is just too great.

So what, then? Do it yourself to save money? History has shown that doing it yourself can be a lot more costly than you might think.

Every dollar you spend in human capital to create your own sales training can actually accelerate the weakening of your sales culture if the time invested doesn’t increase sales or, even worse, results in product pushing and sales discomfort that can damage a salesperson for life.

Today most organizations have professional trainers who are highly skilled at program development and classroom presentation. Yet how many of these trainers have practical sales experience, have the time to study industry best practices in selling, or can engage your top performing sellers in the classroom? Very few.

In our more than 45 years of sales consulting for banks and credit unions our team has seen fewer than a dozen Internally developed sales training programs that weren’t overly simplistic rip-offs of a prior employers’ program or product training disguised as sales training.

Sales training is simple, but it isn’t easy if you haven’t first developed a preferred way of selling for each selling role around which to train. Only an outside group with years of industry sales experience can give you this, and without it, you risk emphasizing the wrong behaviors. reinforcing negative stereotypes about selling that detract from its true purpose of helping others and not moving the sales production numbers.

Add together the months of multiple salaries invested in program development, the opportunity cost in lost sales over several years if your program doesn’t actually increase sales, and the potential cost of regaining lost credibility for your sales culture if your program isn’t well-received by your best performing bankers. That’s the real cost of do it yourself sales training.

You only get one opportunity to do sales right when conditions are suddenly optimal for achieving big gains in market share. In the end, you’re not really saving money with do it yourself sales training if you’re not making money through better selling.

by SchneiderSales | Mar 30, 2020

What We Learned From the 2009 Financial Crisis

What’s next for bank and credit union selling after the world has seemingly turned upside down overnight?

What’s next for bank and credit union selling after the world has seemingly turned upside down overnight?

Right now your employees and your customers are focused totally on their health, on their personal financial survival, and on the survival of their businesses, as they should be.

In the midst of this disruption, smart marketers are laying the foundation for big gains in market share based on lessons learned from the last industry crisis in 2009. During the upswing following the last crisis some organizations made huge gains in growth at the expense of others. They were the companies whose employees were ready to sell.

The opportunity to achieve a fast ROI on your sales efforts will be enormous as customers rethink their finances and banking relationships, reflect on their losses, and consider the new opportunities open to them.

The word fast is key because the recovery is likely to be larger and faster than last time, and the big winners last time were the companies that got the jump on others by using the down period to improve their processes and their sales efforts.

As the nation’s longest operating sales practice for banks and credit unions we’ve seen firsthand what works and what doesn’t work in refocusing and reenergizing a sales team after a crisis. The principles are simple, but successful execution of these principles requires a narrow focus on your best opportunities and a wholistic, integrated approach to sales.

Here’s what we recommend based on what we’ve learned from prior crises:

1. Create a compelling mission to refocus your employees on sales quickly after the crisis.

Begin now to communicate to your employees the importance of your post-crisis mission to help families and businesses get back on their feet. Continually position selling as helping and set big goals for how many customers and prospects you want to help over the second half of the year.

2. Adjust scorecards, goals and sales incentives during the crisis, and again after the crisis, so you don’t lose employee trust and motivation.

When goals are viewed as either unachievable or too easy to accomplish you‘re less likely to motivate employees to give discretionary effort, and you can’t easily hold employees accountable for their performance.

When conditions are changing dramatically, it’s especially important to rely on a balanced scorecard of performance Including behavioral metrics rather than rely solely on sales volume metrics.

3. Use new customer behavior adopted during the crisis such as social distancing to your advantage.

We’re already working with clients to develop strategies for selling more effectively through the drive-up window, the contact center, videoconferencing and online account opening and lending.

4. Use the chaos in the job market to hire bankers who can sell for key positions based on their strengths for specific selling roles.

There will be thousands of people newly available to you, including current employees who are underutilized, who have top producer sales potential based on their behavioral competencies for a specific selling role regardless of their experience. This is especially critical for job roles that are becoming more sales focused such as contact center reps, universal banker and front line supervision.

Upgrade your team by asking line sales leaders to recruit aggressively now when you don’t need staff and by pre-qualifying candidates quickly with role-specific online behavioral testing rather than non-predictive personality tests.

5. Avoid the herd mentality post-crisis rush to e-learning for sales training and instead focus on classroom or small group remote learning featuring disciplined practice and follow-up skill mastery certification.

E-learning is great for learning facts and procedures and for skill reinforcement. However, research has proven that you don’t learn social skills and conversation behaviors like selling without interacting with real people through disciplined practice and getting feedback on the subtleties of those interactions.

Training is really about making people the same in some important way. If you don’t use this time to define clearly your Preferred Way of Selling for each job role, any sales training you do will be a waste of money.

6. Provide existing customers with more attention and easier access to skilled advisors at a time when your customers will be seeking comfort and advice.

This may require you to convert more service staff to universal bankers and create relationship officers to manage high value relationships.

7. Invest in CRM technology that your sales team will actually use and teach your team how to sell with CRM.

The shortest distance between failure and success in selling in a rebound is a straight line to the prospects most likely to buy. CRM can assure that your resources are applied immediately to your best opportunities. Yet very few frontline bankers know how to use their CRM tools effectively in selling, and poorly designed systems providing too many features and screens often make sales conversations with customers overly time consuming and awkward.

8. Use this time to prepare senior sales leaders to provide focus and accountability for selling and to model behaviorally specific coaching for branch and department sales leaders.

Nothing restarts the sales engine faster than senior sales leaders making sales a priority. Similarly, the best way to get frontline managers coaching is to get senior sales leaders coaching.

9. Lay out a game plan for commercial lending and business development teams to rebuild your sales pipeline with blitz call campaigns to target customers and prospects.

You only have one chance to be first to help a business solve a problem. Every call should be made to achieve a specific next step customer action to move the relationship forward, even if the call is a videoconference to influencers who are working remotely at home.

Start Now So You Hit the Upswing at Full Speed

None of these recommendations require rocket science, but they are all based on science and on the lessons of recent history. None will have the desired impact if you start late.

The secret sauce of sales and marketing has always been to narrow your focus to your best opportunities and to strike fast so you dominate the moment or your target market. That’s what has worked for the winners in the upswing that has followed every major crisis.

With so many people in banks and credit unions working remotely or working on the frontline in the midst of chaos, nothing overcomes their fear or offers more hope than the promise of participating in a big mission to help others in need.

Your job is to define that mission and to sell it in time to capture your opportunity.

by SchneiderSales | Dec 10, 2019

If you work in a bank or a credit union you’ve almost certainly heard the concern, “If we commit to creating a stronger sales culture, we’ll lose the relationships and service mindset we’ve worked so hard to build.”

Everyone is familiar with the goal driven, product pushing sales climate that Wells Fargo built, and its disastrous impact on customer loyalty and shareholder value. This and other similar stories are almost always the result of unreasonable performance pressure and greed, not sales culture.

Most experts agree that culture is a key driver of performance. Companies like Chase, Nordstrom, IBM and Apple are high performing sales cultures, yet they’re also market leaders in customer satisfaction? How is that possible?

Most people wrongly associate sales culture with a numbers culture in which performance is defined by short term sales volume and sales activity levels with little regard for customer satisfaction. At the other extreme, sales culture is often compared unfavorably to service culture which is more of a quality assurance or problem avoidance approach to customer experience and customer satisfaction.

In reality, the sales culture modeled by high performing sales organizations is a system of values, beliefs and behaviors focused almost entirely on customer satisfaction and long term profitability. Sales at the expense of customer satisfaction are strongly discouraged simply because they are counterproductive to the mission.

Sales organizations with high employee engagement and high customer satisfaction tend to have higher market share and higher profitability than their competitors. Deloitte found that customer-centric organizations are actually 60 percent more profitable than other companies.

The Case for Sales Culture

I believe strongly that sales culture helps promote customer satisfaction.

In the past 45 plus years, we’ve conducted hundreds of in-depth sales practice assessments and sales climate surveys for some of the best sales organizations in banking like BBVA Compass, Marshall & Ilsley Banks and AmericaFirst Credit Union. I’ve repeatedly found that the better an organization’s sales performance, the more sales is viewed as a step UP from service.

In the numbers cultures I’ve studied, the emphasis on selling anything to meet goals always ends with customers being oversold with products that they don’t need or that aren’t profitable, and with employees product pushing to keep their jobs and experiencing dysfunctional sales discomfort as a result.

In service cultures like those often associated with credit unions, the all-out effort to please members with courtesy, making small talk and working fast to hit efficiency targets all too frequently falls short of actually helping members.

By not encouraging in-depth conversation about emerging needs, explaining the benefits of new products and new technology, or following up initial conversations with onboarding calls and other ways to help, members are ultimately underserved.

Measuring customer experience in terms of just speed, courtesy and absence of problems is misleading. Customer experience also has to be measured in terms of listening, probing, and advising customers on unmet or unaware needs.

According to the University of Michigan-run American Customer Satisfaction Index, banks actually surpassed credit unions in customer satisfaction ratings in 2019 despite the preponderance of service cultures among credit unions.

Are you Building a Sales Culture?

How do you know if you’re on your way to building a customer-focused sales culture or instead to a numbers culture or a service culture? Ask yourself these twelve culture-revealing questions.

1. Are your performance metrics balanced? In a numbers culture, the key metrics are always sales volume and sales activities. In a service culture the key metrics are usually net promoter score and service efficiency scores like wait times. In a true sales culture, the key metrics are a balanced combination of sales results, profitability, customer experience and use of preferred behavior.

2. Are your goals negotiated? In a numbers or service culture, goals are typically assigned. In a sales culture, goals are negotiated based on opportunity and aptitude, usually in combination with a tactical plan that forces a realistic approach to goal setting.

3. Are you hiring for EQ skills and fit with the job role? In a numbers culture, customer facing staff are often hired for their competitiveness and drive while the emphasis in service cultures is usually on sociability and operations experience. In a sales culture employees are hired based on their EQ skills and on their fit with the competencies required for each unique selling role for which commonly used pop personality tests like Predictive Index aren’t predictive of success.

4. Have you defined a Preferred Way of Selling®? In a numbers culture, there is very little concern for how sales are made in contrast to service cultures where there is a lot of emphasis on following a prescribed service routine that enhances speed of delivery and minimizes potential problems.

We’ve registered the phrase Preferred Way of Selling® for sales cultures because every great sales organization has studied and codified its own set of best practice behaviors that work for the company and for each selling role, including how to establish its offerings as clearly different.

5. Is your sales training focused on discovering and selling to the customer’s viewpoint? One of the most startling findings we’ve made in our four decades plus of sales training is that most sales advisors talk 70 percent of the time during a sales conversation compared to the ideal of 30 percent. In a numbers sales culture, this is typically the result of sales training that encourages product dumping. In the case of service cultures talking too much is symptomatic of excessive socializing and

reluctance to ask for next step advances.

In a true sales culture, sales training focuses on conversation skills with a lot of disciplined practice around seeking information that can be used to help the customer. Even the language used in sales training in sales cultures is different with the word helping frequently associated with both selling and coaching.

6. Is your coaching based on observation and on giving specific behavioral feedback? In our corporate assessments, we see a lot of evidence that coaching is occurring, but it seems to vary greatly by culture. In a numbers culture coaching amounts to “get your numbers up” with almost no “how to’s.” In a service culture coaching is frequently limited to transactional quick coaching around service standards with little strategic direction.

In sales cultures, managers are typically asked to give both behavioral feedback and broader direction on strategy.

7. Is your technology customer-centric? In a numbers culture, CRM and operating platforms typically provide structured sales pitches based on prompts generated by customer profiles often leading to sales by “immaculate conception” with little thinking

by the sales advisor. In a service culture technology is used primarily for improving

transaction efficiency.

In sales cultures technology is designed to assist sales advisors in conversational selling and in prioritizing sales and service contacts.

8. Are people recognized and compensated for doing the right things? In a numbers culture, recognition and compensation is driven entirely by achieving your individual numerical goals. In service cultures, individual accountability is often diluted by team based recognition and compensation formulas. The best sales cultures reward both behavior and goal achievement.

9. Do sales and marketing report to the same person? In both numbers cultures and service cultures, sales and marketing typically operate from separate silos with only minimal coordination between them. In sales cultures sales and marketing frequently report through a chief revenue officer who can maintain an integrated customer focus across both functions.

10. Are senior executives rewarded for developing their managers? In a numbers culture or a service culture, senior executives tend to be rewarded entirely for achieving their numerical goals whether those goals are for sales production or for customer satisfaction and efficiency.

In sales cultures, senior executives are often rewarded almost entirely for the percentage of their employees who meet goal and the percentage who meet personal development standards such as certifications of skill mastery. Since managers are the key leverage point for improvement, senior executives are given incentive to coach up every manager so they can’t rely on a few top producers to hit their goals.

11. Is the market feedback you rely on based on actual customer perception and is it specific with regard to employee behavior? In a numbers culture or a service culture, market feedback is typically limited to satisfaction surveys, net promoter scores and shopper surveys which are organized around preset perceptions of the factors customers think are important.

In sales cultures customer feedback processes like focus groups and our AdvisorScore survey are used to give unstructured customer feedback and specific behavioral feedback that can be used in providing specific coaching direction to employees.

12. Are job roles organized around customer relationship needs? In a numbers culture or service culture job roles tend to be structured for efficiencies such as maximizing the number of customers seen per banker per day. In sales cultures job roles tend to be organized to facilitate seamless one-stop interactions for customers.

Selling Your Employees on Sales Culture

Obviously, there are a lot of moving parts when it comes to executing well on sales culture. The strategic integration of these moving parts around the customer’s viewpoint is what makes sales culture so helpful to increasing customer satisfaction.

It seems paradoxical in light of the sales discomfort still prevalent in financial services, but customer satisfaction improves more with sales culture than with service culture. Helping people fully does seem to require a broad view of customer relationships that is heightened by sales priorities. Virtually every sales initiative we undertake for our clients increases customer satisfaction as well as sales and earnings.

Bottom line, to really help your customers, you first have to sell your organization on sales culture.

Jim Schneider is President & CEO of Schneider Sales Management, Inc. and author of The Sales Producers, How the World’s Top Salespeople Sell.

by James Schneider | Feb 27, 2019

Add Your Email Below to Download Our World-Class Pre-Coaching Planner… for FREE.

Today’s downloadable toolbox guide is the top guide for Coaching and Developing Sales Talent.

Banks and Credit Unions all around the country use Schneider Sales Management, Inc’s forms to work one-on-one with employees to set the goals that improve sales revenue, improve customer service, and improve employee performance.

Download the form above by entering your email address, or forward this page to a financial industry sales manager who you want to see improve quickly.

Preparation Will Focus Your Coaching

You can cut through to the real leverage point for improving an employee’s performance by asking yourself the few simple questions shown on the Pre-Coaching Planning Guide on the next page. This form puts an employee’s nonperformance in perspective so you can diagnose the real cause of the performance problem, and you can ask for the appropriate corrective action by an employee.

Understand Your Employees’ Behavior

Always ask yourself how often and how well an employee does what you want him/her to do. If an employee has never done what you want him/her to do, you probably have a training problem.

If he/she has done it before, but doesn’t do it consistently, or if he/she does it poorly, you probably have a motivation problem, or a coaching problem.

If you’re still not sure that you’ve identified the right performance problem, ask yourself if the employee could and would ever do it, even if his/her job depended on it. If your answer is no, you probably have a job fit problem, and more coaching isn’t the right solution.

Get Clarity on Specific Improvements

Finally, the most important step in all of your performance analysis is to define in one sentence, very specifically, what it is that you want the employee to do to improve his/her performance.

If you can’t do this, you haven’t yet identified the real performance problem, and you won’t be clear in telling the employee what action to take to improve.

by James Schneider | Feb 21, 2019

In the financial industry, different job roles require different core competencies.

For each job role, some core competencies are more important that others, and your evaluation of candidates should give extra attention to assessing those few critical attributes. Some attributes are nice to have, but the core competencies should be considered “must have.” Don’t overvalue one competency at the expense of others. Star performers typically have strengths across a range of competencies for their optimum selling role.

Competencies are the skills, abilities and motivations that actually cause effective and/or superior performance in a job role. A characteristic is not a competency unless there is evidence that indicates that possession of the characteristic precedes and leads to effective and/or superior performance in a job as measured on a specific criterion or standard.

Distinguishing competencies are those skills or abilities that differentiate superior performance from average or poor performance such as a salesperson setting goals higher than the goals required by the organization.

Here are some of the core competencies and sample job roles for each type of selling. Take a look and see if you’re valuing the competencies for each role that are going to make the biggest difference for your bottom-line revenue.

Service Selling

Core competencies:

Achievement Drive, Initiative, Energy, Organization Skills, Sociability, Empathy

Sample job roles:

• Teller

• Receptionist/Greeter

• Contact Center Rep (In-bound service)

• Loan Processor

Consultative Selling

Core competencies: Achievement Drive, Optimism, Adaptability, Social Leadership, Creative Quick Thinking, Organization Skills

Sample job roles:

• Personal Banker/Universal Banker

• Customer Service Rep.

• Member Service Advisor/Personal Banker

• Contact Center Rep (In-bound sales)

• Consumer Loan Officer

• Internal Mortgage Originator

• Insurance Consultant

• Investment Officer

Competitive Selling

Core competencies: Achievement Drive, Drive to Persuade, Optimism, Resilience Energy, Organizational Skills

Sample job roles:

• Business Development Officer

• Small Business Banking Officer

• Trust Officer–Employee Benefits

• External Mortgage Originator

• Wholesale Mortgage Lender

• Contact Center Rep (Outbound Sales)

Complex Selling

Core competencies: Achievement Drive, Empathy, Self-Control, Planning & Analytical Thinking, Social Leadership, Organization

Sample job roles:

• Commercial Loan Officer

• Trust BDO/Administrator

• Wealth Management Advisor

• Private Banker

• Cash Management Officer

Sales Supervision

Core competencies: Achievement Drive, Empathy, Developing Others, Optimism, Collaboration, Planning & Analytical Thinking

Sample job roles:

• Business Unit Manager

• Regional Manager

• Branch Manager

• Sales Manager

• Assistant Branch Manager

• Operations Supervisor

• Contact Center Supervisor

by James Schneider | Feb 14, 2019

This article originally appeared in USA Today!

Let other vocations have their bawdy bumper stickers, it’s really successful sales people who are the best lovers, says Jim Schneider.

“Think about it,” says the president of Denver-based Schneider Sales Management, Inc., a sales training and consulting firm:

“The best sellers are able to relax and think of the other person, instead of thinking of their performances. And as a result, they’re more sensitive to what works and what doesn’t. They adjust naturally to the needs of the moment.”

Of course Schneider, who tries to teach his trainees to think more about the client’s needs and desires than their own performances and sales quotas, isn’t absolutely sure about his theory. “I can demonstrate that our people are good sellers,” he says with a laugh, “but I haven’t really tried to track their bedroom performance yet.”

Click Below to Download our #1 Form for Negotiating and Setting Sales Goals at Banks and Credit Unions.

by James Schneider | Jan 23, 2019

Most sales leaders treat all people and all selling situations as if they were the same. They’re not. A 7’7″ basketball player like former NBA player Manute Bol may not be very skilled at shooting and dribbling, but he may be the player on the team best fit to rebound and to block shots. Similarly, an employee may not have the patience, empathy and planning skills to succeed at long cycle selling, but he may be our company’s best salesperson at prospecting and closing short cycle transactional sales.

National research of high performing salespeople in the financial services industry by Schneider Sales Management, Inc. has proven that almost all sales positions and all distinguishing sets of sales competencies can be described by five selling roles based on the behavioral requirements for success in the job. These roles are appropriate for all financial institutions based on the behavior competencies required to perform each role.

All top producing salespeople have some crucial competencies in common, such as strong achievement drive, but each selling role requires some competencies that are different than those required for other selling roles.

If you are a hiring manager or a sales manager, it is your responsibility within your bank or credit union to define clearly what each employee’s role in selling is, and to fit the right people to the right role to build a successful team.

Choosing the right sales practices, the right performance metrics and the right coaching priorities is easy once you’ve defined each employee’s role in selling.

Here is more information on each of the five main financial industry selling roles in banks and credit unions.

Service: Job requires servicing customer transactions and maintaining friendly customer relations, and may require conducting some referral or suggestive selling.

Consultative Selling: Job requires completing sales and service transactions, advising customers on product selection or use, closing first sales quickly, making add-on or follow-up sales, and managing selected customer relationships in primarily in-store, customer-initiated conversations. In blended sales and service positions the job may also require proactive outreach to approach and engage in-store customers to create sales opportunities.

Competitive Selling: Job requires continuous prospecting, competing for sales persistently despite high rejection rates, conducting minimal after-sale servicing, and closing competitive sales in one or two interviews using emotional pressure.

Complex Selling: Job requires closing large, complex or technical sales over a long selling cycle, analyzing prospect problems and product applications to propose customized solutions, networking socially for new business, and retaining and developing customer relationships over time.

Sales Supervision: Job primarily requires direct supervision and coaching of sales personnel and/or their supervisors, and typically requires some personal selling. In senior level positions the job also requires sales planning.

by James Schneider | Jan 23, 2019

Add Your Email to Download the #1 Form for Negotiating and Setting Sales Goals in the Financial Industry… for FREE.

Today’s downloadable toolbox form is the #1 form for Negotiating and Setting Sales Goals with financial industry salespeople. Banks and Credit Unions all around the country use these forms to work one-on-one with employees to set the goals that improve sales revenue, improve customer service, and improve employee performance.

Download the form above, or forward this page to a financial industry sales manager who you want to see improve quickly.

Set sales goals that help your employees stretch to increase revenue.

The most basic measurement of a sales leader’s performance is the percentage of employees that he/she supervises that meet or exceed their projected sales goals.

How you set these goals with each employee is vital to whether or not employees take ownership and strive to meet and beat those goals.

The sales goals you set determine the revenue and potential of each employee.

Goal setting must be done in face-to-face meetings with each person who reports to you. You get commitment by talking to people, not by writing to them. Allocate enough uninterrupted time to the task to do it right.

Goals should be high enough to motivate people to give extra effort and low enough to seem possible and to provide frequent opportunities for success and positive reinforcement. The motivation to achieve a goal is highest when the perceived likelihood of success is about 50%.

Generally, the higher the goals, the better the performance, provided a difficult goal is accepted as important and attainable. However high the goal, you MUST hold the employee accountable for achieving the goal.

Employees are frequently too optimistic in their forecasting. These are your goals, too, so you want them to be realistic. When an employee seems overly optimistic, say, “20% would be great, but let’s shoot for 10% for now. When we get that, we’ll try for something higher.”

Ask HOW each goal can be achieved

The only way to be sure that an employee’s goals are realistic is to ask the employee how he/she intends to accomplish his/her goals. Ask each employee what he/she could do to move his/her goals to the stretch goals, and then keep asking what else he/she could do and offering you own suggestions until it seems there isn’t much more he/ she could do. At that point you’ve probably reached a reasonable expected goal for his/her performance to include in your budget.

Negotiate sales goals that fit the opportunity and competency of each employee

Use questions to negotiate. It’s crucial that you gain each employee’s commitment to realistic goals that are neither too low or too high. The best way to do this is to use questions to force each employee to think through fully how he/she could accomplish his/ her proposed goals.

Follow-up to Help Push Employees Forward

Once an employee’s goals have been set, the sales manager’s final role in goal setting begins— following up to ask the employee about his/her progress in accomplishing the goals and continually refocusing on him/her on his/her best opportunities to accomplish the goals.

Ask your employees about their progress toward their goals frequently and sell them on the high probability of their achieving them. When a sales leader frequently checks an employee’s progress against a goals prior to the deadline, the employee is more likely to believe that he/she can achieve the goals. You MUST follow-up.

Hold each employee accountable for his/her goals. Employees engaged in long cycle selling should be given feedback on their progress toward their goals at least weekly, and branch employees should report their sales daily. Remind your employees that they’re setting goals for their own benefit, and that they’re letting themselves down by not meeting them.

by James Schneider | Jan 19, 2019

For many banks, universal banker has delivered on the promise of cost savings, seamless service, and recognition of more sales opportunities. Most banks, however, have had poor results. Here’s why.

To save money, most banks simply promote their existing teller staff to the much more proactive universal banker role and eliminate entirely the role of personal bankers who provide in-depth sales advice and make outbound calls. They install performance metrics and compensation that rewards efficiency over sales productivity. Little or no training is done to teach universal bankers how to approach customers and convert assisted transactions into sit-down appointments.

And then we wonder why another interesting innovation in customer experience fails. For advice on how to maximize sales from your universal banker team, call us at (303) 221-4511.

by Mike Shallanberger | Jan 15, 2019

“I view my primary job as strengthening our talent pool.” — Jack Welch

No amount of coaching can offset poor hiring decisions, and the cost of a bad hire is estimated conservatively to be at least two or three times an employee’s annual salary plus thousands of dollars in lost opportunity cost for sales not made and for customers lost. The society for Human Resource Management (SHRM) estimates a hiring mistake could even cost as much as five times the employee’s annual salary.

The new reality in our industry is that we now have to get more sales from fewer people. It’s particularly crucial that you identify strategically critical jobs, and then invest your time and resources disproportionately to ensure that the right people, doing the right things, are in these positions. The more complex the sales or sales leadership task is, the bigger the performance gap between top and low performers.

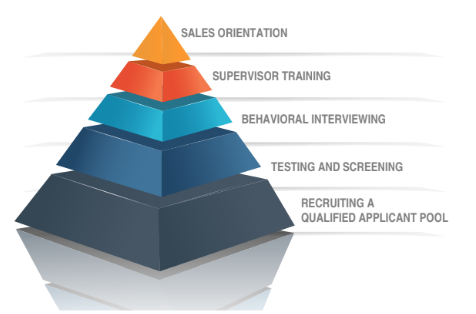

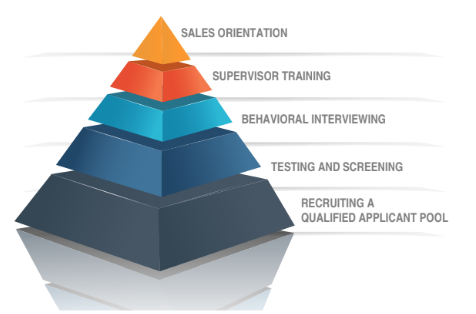

That’s why Schneider Sales Management has developed a five dimensional hiring process. It works like a funnel that starts with the hiring managers and ends with satisfied, productive employees who meet (or beat!) sales performance standards.

Starting at the bottom of the funnel and working up, the first stage of the five dimensional hiring process is continuous talent recruiting. To be successful at strengthening the sales staff, hiring managers need to recruit continuously, tailor their recruiting to target applicants (or, “fish where the fish are,” as the old adage goes), and build the applicant pool by selling the opportunity of working at your organization.

In the testing and screening stage of this process, hiring managers need to find the right tools to prescreen applicants quickly for fit to their sales roles, and find effective ways to maximize the impact of the first in-person interview. Once candidates have been tested and screened, they can be interviewed based on their personality traits and behaviors.

These behavioral interviews will focus interviews on required behavior and results and adhere to a structured interview guide. The interviewees’ answers during behavioral interviews should be compared to and measured against the job requirements, not to other candidates’ responses. There is a right and wrong way to interview, so make sure you’re adhering to legal standards during each candidate conversation.

After the selection process comes two of the most vital stages—stages that many financial institutions mistakenly consider separate from the hiring process.

Each new hire needs a strong sales orientation program and a conditional job offer with an onboarding plan in place. It’s important to outline expectations for new salespeople early on to avoid any confusion about the job role and to get them out of the starting blocks strong.

These tools together create hiring that can give banks and credit unions the quantum leap in performance that they need. Hiring mistakes are too expensive to make, and changing your hiring behaviors is an investment that your organization can make to improve your overall culture and revenue.

We’re the only firm in the industry that can help you put in place a process with these five dimensions. For more information on our support for hiring and HR managers, call us today at 303-221-4511.

What’s next for bank and credit union selling after the world has seemingly turned upside down overnight?

What’s next for bank and credit union selling after the world has seemingly turned upside down overnight?