Why is a Five Dimensional Hiring Process Better for Banks?

“I view my primary job as strengthening our talent pool.” — Jack Welch

No amount of coaching can offset poor hiring decisions, and the cost of a bad hire is estimated conservatively to be at least two or three times an employee’s annual salary plus thousands of dollars in lost opportunity cost for sales not made and for customers lost. The society for Human Resource Management (SHRM) estimates a hiring mistake could even cost as much as five times the employee’s annual salary.

The new reality in our industry is that we now have to get more sales from fewer people. It’s particularly crucial that you identify strategically critical jobs, and then invest your time and resources disproportionately to ensure that the right people, doing the right things, are in these positions. The more complex the sales or sales leadership task is, the bigger the performance gap between top and low performers.

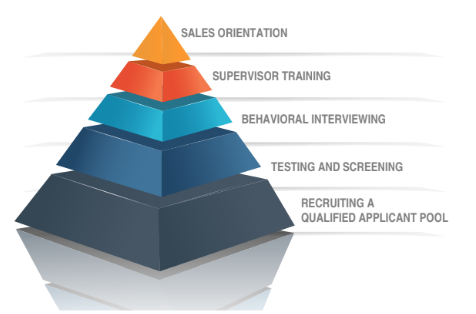

That’s why Schneider Sales Management has developed a five dimensional hiring process. It works like a funnel that starts with the hiring managers and ends with satisfied, productive employees who meet (or beat!) sales performance standards.

Starting at the bottom of the funnel and working up, the first stage of the five dimensional hiring process is continuous talent recruiting. To be successful at strengthening the sales staff, hiring managers need to recruit continuously, tailor their recruiting to target applicants (or, “fish where the fish are,” as the old adage goes), and build the applicant pool by selling the opportunity of working at your organization.

In the testing and screening stage of this process, hiring managers need to find the right tools to prescreen applicants quickly for fit to their sales roles, and find effective ways to maximize the impact of the first in-person interview. Once candidates have been tested and screened, they can be interviewed based on their personality traits and behaviors.

These behavioral interviews will focus interviews on required behavior and results and adhere to a structured interview guide. The interviewees’ answers during behavioral interviews should be compared to and measured against the job requirements, not to other candidates’ responses. There is a right and wrong way to interview, so make sure you’re adhering to legal standards during each candidate conversation.

After the selection process comes two of the most vital stages—stages that many financial institutions mistakenly consider separate from the hiring process.

Each new hire needs a strong sales orientation program and a conditional job offer with an onboarding plan in place. It’s important to outline expectations for new salespeople early on to avoid any confusion about the job role and to get them out of the starting blocks strong.

These tools together create hiring that can give banks and credit unions the quantum leap in performance that they need. Hiring mistakes are too expensive to make, and changing your hiring behaviors is an investment that your organization can make to improve your overall culture and revenue.

We’re the only firm in the industry that can help you put in place a process with these five dimensions. For more information on our support for hiring and HR managers, call us today at 303-221-4511.