by James Schneider | Feb 27, 2019

Add Your Email Below to Download Our World-Class Pre-Coaching Planner… for FREE.

Today’s downloadable toolbox guide is the top guide for Coaching and Developing Sales Talent.

Banks and Credit Unions all around the country use Schneider Sales Management, Inc’s forms to work one-on-one with employees to set the goals that improve sales revenue, improve customer service, and improve employee performance.

Download the form above by entering your email address, or forward this page to a financial industry sales manager who you want to see improve quickly.

Preparation Will Focus Your Coaching

You can cut through to the real leverage point for improving an employee’s performance by asking yourself the few simple questions shown on the Pre-Coaching Planning Guide on the next page. This form puts an employee’s nonperformance in perspective so you can diagnose the real cause of the performance problem, and you can ask for the appropriate corrective action by an employee.

Understand Your Employees’ Behavior

Always ask yourself how often and how well an employee does what you want him/her to do. If an employee has never done what you want him/her to do, you probably have a training problem.

If he/she has done it before, but doesn’t do it consistently, or if he/she does it poorly, you probably have a motivation problem, or a coaching problem.

If you’re still not sure that you’ve identified the right performance problem, ask yourself if the employee could and would ever do it, even if his/her job depended on it. If your answer is no, you probably have a job fit problem, and more coaching isn’t the right solution.

Get Clarity on Specific Improvements

Finally, the most important step in all of your performance analysis is to define in one sentence, very specifically, what it is that you want the employee to do to improve his/her performance.

If you can’t do this, you haven’t yet identified the real performance problem, and you won’t be clear in telling the employee what action to take to improve.

by James Schneider | Nov 13, 2018

The Wells Fargo “quota-gate” incident has exposed as myth many of the financial industry’s long held beliefs about what makes a great sales organization. Even the best sales practices become unethical when they encourage greed rather than customer satisfaction.

The unethical sales practices at Wells Fargo come as no surprise to those of us who follow bank sales practices closely. Wells has been recording industry best cross-sell ratios while churning customers and employees for several decades through relentless product pushing. If you ask many bank or credit union executives about their sales culture, their first response is usually, “We don’t want to be a Wells Fargo.”

The knee-jerk reaction to this news may be to pull back from selling and setting sales goals altogether. That would be a mistake. The Hay Group has found that the nation’s most admired companies actually set more challenging goals for employees than other companies.

The good news is that it’s entirely possible to have strong sales proficiency with ethical sales behavior. Our philosophy has always been to focus on the customer, rather than on the products, to help your customers and to increase sales. Here’s a good place to start.

At Schneider Sales Management, every sales manager and employee in a sales or service role is held to a shared Selling Creed of Ethics. This shared system of values guides each decision made from the top down when it comes to hiring, training, coaching, and evaluating sales behavior.

Our Personal Selling Code of Ethics

We do whatever it takes inside or outside the formal boundaries of our solutions yet within the legal constraints of our business to help our customers with our selling so the value they receive far exceeds what they pay.

We treat every customer with respect so he/she feels important, comfortable and understood, even adapting our behavior as necessary to maximize our rapport and mutual trust.

We do what’s right for our customers and for our organization, even if that results in the loss of an immediate sale.

We do our homework, listen carefully as customers speak, and ask the right questions to fully understand a customer’s situation and objectives before recommending solutions.

We’re proactive in seeking information, in offering new insight into the impact of each customer’s current way of doing things, in making recommendations and referrals, and in urging customers to move forward with good ideas to help them improve their current personal or business situation.

We never use high pressure selling tactics as a substitute for coaching customers to their own decisions with questions.

We conduct selling with integrity and high ethics by not misleading customers, by complying with all legal and company requirements for selling, and by not overpromising what we can do for customers.

We give as much importance to what happens after a sale to assure customer satisfaction as we do to what happens during the sales process.

We commit ourselves to continuous, disciplined learning of the core competencies required for our selling role so we remain competent and trusted advisors to our customers.

We outwork our competitors and we work smart in allocating our sales time to our established priorities.

If your financial institution isn’t living up to these standards, it’s time to reexamine your sales process from the top down. Schneider Sales Management provides audits and shops as part of our consulting services. Call us today at (303) 221-4511 and get on track for a better 2019.

by James Schneider | Nov 10, 2018

One of the most valuable ways that sales managers can impact the overall revenue of a bank or credit union is to adjust his or her mindset for success and support their sales staff as they adjust their mindsets about selling. It’s a non-negotiable part of achieving and exceeding your revenue goals, and while it’s a simple shift, it’s not always easy to change deeply-held beliefs about selling.

The biggest obstacle to making a quantum leap in sales production or profit contribution of 50% or more is the belief that it’s not possible. As consultants to financial institutions for more than forty years, our team at Schneider Sales Management, Inc. has seen this limiting belief again and again.

Making a quantum leap is possible. Believe it.

The difference in sales results between average and top performers is often 100%, or more, yet the differences in what they say or do to produce these results are usually very small. For many employees, achieving a quantum leap in performance may require doing 2 or 3 things different or better. For others, they may only have to apply more effort by increasing the number of sales interviews they have. Sales managers provide maximum value when they can identify these opportunities for explosive improvement.

Providing clear sales direction requires that sales managers narrow the focus for the sales team by translating company, regional, and branch business goals into specific target objectives, strategies, relationships and preferred behaviors for each employee.

Sales managers who keep a narrow focus can establish accountability for improvement and for getting done what needs to get done to accomplish the company’s goals.

Simplifying the mission for employees and explaining its importance builds employee engagement, and employee engagement is the best predictor of sales growth.

A great sales manager can impact an entire company’s success in selling by simply adopting a mindset of success and committing to the small, everyday changes that can lead to huge revenue growth. Salespeople look to sales managers to lead a cavalry charge in both behavior and in mindset.

Get your mindset right; get your sales up. It’s simple, but that doesn’t mean it’s easy.

Call us today for a conversation about how Schneider Sales Management can support your organization’s 2019 sales goals.

by Mike Shallanberger | Oct 2, 2018

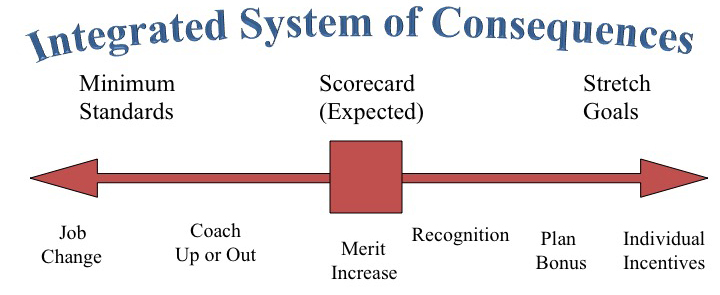

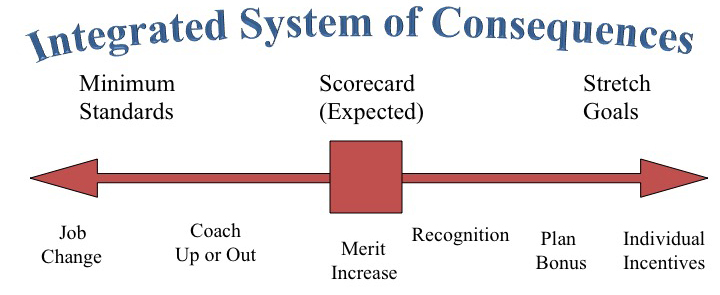

Give a child a cookie and you can get him to take a nap or clean his room. Behavior can definitely be influenced by rewards—something we never outgrow. But do sales incentives work? Unfortunately, bankers typically misuse incentive pay by choosing the wrong behavior to reward or by rewarding everyone regardless of discretionary effort. In most cases, results under incentive plans are the same as if we had simply managed and coached employees better…

Banks and credit unions fund sales incentive plans to get employees to do more. But more of what? Doing more of some activities and some sales production is actually counter-productive. Just ask any mortgage bankers who lost their shirt compensating lenders for overselling low-down payment loans, or branch managers who are seeing dozens of investment referral attempts with no closed business.

In some selling roles, bank incentive programs may not be cost effective and aren’t even terribly motivating. When we ask top producing tellers why they are making 100 referrals a month when most tellers only make 1 or 2, the answer isn’t the extra $5 they make on each referral. The answer is almost always that making 100 referrals per month will get them noticed, and if they get noticed they can get promoted.

Sales compensation is driven by employee scorecards and goals. If the scorecards are balanced or weighted properly, you’ll pay for the wrong results. If the goals are off, you either overcompensate employees or demotivate them. Surprisingly, we find that most banks and credit unions overpay their employees with incentive dollars by trying to pay everyone something instead of paying their best contributors more for the results that matter most.

To realize maximum value for your incentive payouts, pay only for sales above a goal level achievable by training and good supervision alone. Pay for behavior and outcomes that are profitable, within the employee’s control and associated directly with discretionary effort. Finally, pay disproportionately to top producers and supervisors who drive most of your production. At most financial institutions, 50% or more of incentive dollars go to average performers.

To encourage sales leaders to coach, pay them for achieving a specified percentage of employees meeting goals so they can’t rely on one or two employees to carry their team without coaching everyone. One of the most successful and sustainable incentive programs we’ve seen paid regional managers on two factors – the percentage of employees meeting and exceeding goal and the percentage of employees who met the requirements to be promoted to the next level.

Sign up for The Schneider Report below for free tips on how to increase your revenue, hire employees who can sell, and increase customer satisfaction.