Do Incentives Work to Drive Performance? The answer might surprise you.

Give a child a cookie and you can get him to take a nap or clean his room. Behavior can definitely be influenced by rewards—something we never outgrow. But do sales incentives work? Unfortunately, bankers typically misuse incentive pay by choosing the wrong behavior to reward or by rewarding everyone regardless of discretionary effort. In most cases, results under incentive plans are the same as if we had simply managed and coached employees better…

Banks and credit unions fund sales incentive plans to get employees to do more. But more of what? Doing more of some activities and some sales production is actually counter-productive. Just ask any mortgage bankers who lost their shirt compensating lenders for overselling low-down payment loans, or branch managers who are seeing dozens of investment referral attempts with no closed business.

In some selling roles, bank incentive programs may not be cost effective and aren’t even terribly motivating. When we ask top producing tellers why they are making 100 referrals a month when most tellers only make 1 or 2, the answer isn’t the extra $5 they make on each referral. The answer is almost always that making 100 referrals per month will get them noticed, and if they get noticed they can get promoted.

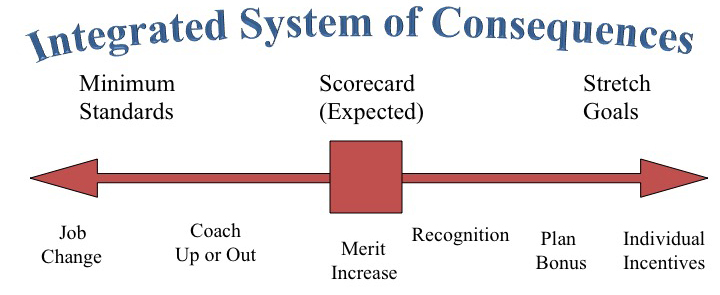

Sales compensation is driven by employee scorecards and goals. If the scorecards are balanced or weighted properly, you’ll pay for the wrong results. If the goals are off, you either overcompensate employees or demotivate them. Surprisingly, we find that most banks and credit unions overpay their employees with incentive dollars by trying to pay everyone something instead of paying their best contributors more for the results that matter most.

To realize maximum value for your incentive payouts, pay only for sales above a goal level achievable by training and good supervision alone. Pay for behavior and outcomes that are profitable, within the employee’s control and associated directly with discretionary effort. Finally, pay disproportionately to top producers and supervisors who drive most of your production. At most financial institutions, 50% or more of incentive dollars go to average performers.

To encourage sales leaders to coach, pay them for achieving a specified percentage of employees meeting goals so they can’t rely on one or two employees to carry their team without coaching everyone. One of the most successful and sustainable incentive programs we’ve seen paid regional managers on two factors – the percentage of employees meeting and exceeding goal and the percentage of employees who met the requirements to be promoted to the next level.

Sign up for The Schneider Report below for free tips on how to increase your revenue, hire employees who can sell, and increase customer satisfaction.