by James Schneider | Feb 21, 2019

In the financial industry, different job roles require different core competencies.

For each job role, some core competencies are more important that others, and your evaluation of candidates should give extra attention to assessing those few critical attributes. Some attributes are nice to have, but the core competencies should be considered “must have.” Don’t overvalue one competency at the expense of others. Star performers typically have strengths across a range of competencies for their optimum selling role.

Competencies are the skills, abilities and motivations that actually cause effective and/or superior performance in a job role. A characteristic is not a competency unless there is evidence that indicates that possession of the characteristic precedes and leads to effective and/or superior performance in a job as measured on a specific criterion or standard.

Distinguishing competencies are those skills or abilities that differentiate superior performance from average or poor performance such as a salesperson setting goals higher than the goals required by the organization.

Here are some of the core competencies and sample job roles for each type of selling. Take a look and see if you’re valuing the competencies for each role that are going to make the biggest difference for your bottom-line revenue.

Service Selling

Core competencies:

Achievement Drive, Initiative, Energy, Organization Skills, Sociability, Empathy

Sample job roles:

• Teller

• Receptionist/Greeter

• Contact Center Rep (In-bound service)

• Loan Processor

Consultative Selling

Core competencies: Achievement Drive, Optimism, Adaptability, Social Leadership, Creative Quick Thinking, Organization Skills

Sample job roles:

• Personal Banker/Universal Banker

• Customer Service Rep.

• Member Service Advisor/Personal Banker

• Contact Center Rep (In-bound sales)

• Consumer Loan Officer

• Internal Mortgage Originator

• Insurance Consultant

• Investment Officer

Competitive Selling

Core competencies: Achievement Drive, Drive to Persuade, Optimism, Resilience Energy, Organizational Skills

Sample job roles:

• Business Development Officer

• Small Business Banking Officer

• Trust Officer–Employee Benefits

• External Mortgage Originator

• Wholesale Mortgage Lender

• Contact Center Rep (Outbound Sales)

Complex Selling

Core competencies: Achievement Drive, Empathy, Self-Control, Planning & Analytical Thinking, Social Leadership, Organization

Sample job roles:

• Commercial Loan Officer

• Trust BDO/Administrator

• Wealth Management Advisor

• Private Banker

• Cash Management Officer

Sales Supervision

Core competencies: Achievement Drive, Empathy, Developing Others, Optimism, Collaboration, Planning & Analytical Thinking

Sample job roles:

• Business Unit Manager

• Regional Manager

• Branch Manager

• Sales Manager

• Assistant Branch Manager

• Operations Supervisor

• Contact Center Supervisor

by James Schneider | Jan 19, 2019

For many banks, universal banker has delivered on the promise of cost savings, seamless service, and recognition of more sales opportunities. Most banks, however, have had poor results. Here’s why.

To save money, most banks simply promote their existing teller staff to the much more proactive universal banker role and eliminate entirely the role of personal bankers who provide in-depth sales advice and make outbound calls. They install performance metrics and compensation that rewards efficiency over sales productivity. Little or no training is done to teach universal bankers how to approach customers and convert assisted transactions into sit-down appointments.

And then we wonder why another interesting innovation in customer experience fails. For advice on how to maximize sales from your universal banker team, call us at (303) 221-4511.

by James Schneider | Nov 10, 2018

One of the most valuable ways that sales managers can impact the overall revenue of a bank or credit union is to adjust his or her mindset for success and support their sales staff as they adjust their mindsets about selling. It’s a non-negotiable part of achieving and exceeding your revenue goals, and while it’s a simple shift, it’s not always easy to change deeply-held beliefs about selling.

The biggest obstacle to making a quantum leap in sales production or profit contribution of 50% or more is the belief that it’s not possible. As consultants to financial institutions for more than forty years, our team at Schneider Sales Management, Inc. has seen this limiting belief again and again.

Making a quantum leap is possible. Believe it.

The difference in sales results between average and top performers is often 100%, or more, yet the differences in what they say or do to produce these results are usually very small. For many employees, achieving a quantum leap in performance may require doing 2 or 3 things different or better. For others, they may only have to apply more effort by increasing the number of sales interviews they have. Sales managers provide maximum value when they can identify these opportunities for explosive improvement.

Providing clear sales direction requires that sales managers narrow the focus for the sales team by translating company, regional, and branch business goals into specific target objectives, strategies, relationships and preferred behaviors for each employee.

Sales managers who keep a narrow focus can establish accountability for improvement and for getting done what needs to get done to accomplish the company’s goals.

Simplifying the mission for employees and explaining its importance builds employee engagement, and employee engagement is the best predictor of sales growth.

A great sales manager can impact an entire company’s success in selling by simply adopting a mindset of success and committing to the small, everyday changes that can lead to huge revenue growth. Salespeople look to sales managers to lead a cavalry charge in both behavior and in mindset.

Get your mindset right; get your sales up. It’s simple, but that doesn’t mean it’s easy.

Call us today for a conversation about how Schneider Sales Management can support your organization’s 2019 sales goals.

by Mike Shallanberger | Oct 2, 2018

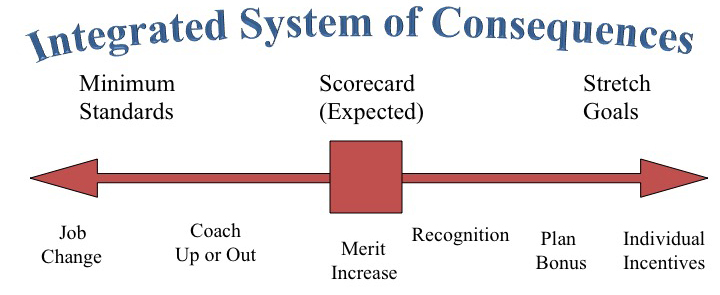

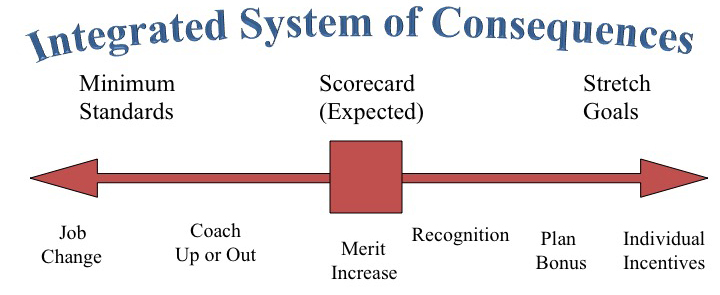

Give a child a cookie and you can get him to take a nap or clean his room. Behavior can definitely be influenced by rewards—something we never outgrow. But do sales incentives work? Unfortunately, bankers typically misuse incentive pay by choosing the wrong behavior to reward or by rewarding everyone regardless of discretionary effort. In most cases, results under incentive plans are the same as if we had simply managed and coached employees better…

Banks and credit unions fund sales incentive plans to get employees to do more. But more of what? Doing more of some activities and some sales production is actually counter-productive. Just ask any mortgage bankers who lost their shirt compensating lenders for overselling low-down payment loans, or branch managers who are seeing dozens of investment referral attempts with no closed business.

In some selling roles, bank incentive programs may not be cost effective and aren’t even terribly motivating. When we ask top producing tellers why they are making 100 referrals a month when most tellers only make 1 or 2, the answer isn’t the extra $5 they make on each referral. The answer is almost always that making 100 referrals per month will get them noticed, and if they get noticed they can get promoted.

Sales compensation is driven by employee scorecards and goals. If the scorecards are balanced or weighted properly, you’ll pay for the wrong results. If the goals are off, you either overcompensate employees or demotivate them. Surprisingly, we find that most banks and credit unions overpay their employees with incentive dollars by trying to pay everyone something instead of paying their best contributors more for the results that matter most.

To realize maximum value for your incentive payouts, pay only for sales above a goal level achievable by training and good supervision alone. Pay for behavior and outcomes that are profitable, within the employee’s control and associated directly with discretionary effort. Finally, pay disproportionately to top producers and supervisors who drive most of your production. At most financial institutions, 50% or more of incentive dollars go to average performers.

To encourage sales leaders to coach, pay them for achieving a specified percentage of employees meeting goals so they can’t rely on one or two employees to carry their team without coaching everyone. One of the most successful and sustainable incentive programs we’ve seen paid regional managers on two factors – the percentage of employees meeting and exceeding goal and the percentage of employees who met the requirements to be promoted to the next level.

Sign up for The Schneider Report below for free tips on how to increase your revenue, hire employees who can sell, and increase customer satisfaction.