by Mike Shallanberger | Jan 15, 2019

“I view my primary job as strengthening our talent pool.” — Jack Welch

No amount of coaching can offset poor hiring decisions, and the cost of a bad hire is estimated conservatively to be at least two or three times an employee’s annual salary plus thousands of dollars in lost opportunity cost for sales not made and for customers lost. The society for Human Resource Management (SHRM) estimates a hiring mistake could even cost as much as five times the employee’s annual salary.

The new reality in our industry is that we now have to get more sales from fewer people. It’s particularly crucial that you identify strategically critical jobs, and then invest your time and resources disproportionately to ensure that the right people, doing the right things, are in these positions. The more complex the sales or sales leadership task is, the bigger the performance gap between top and low performers.

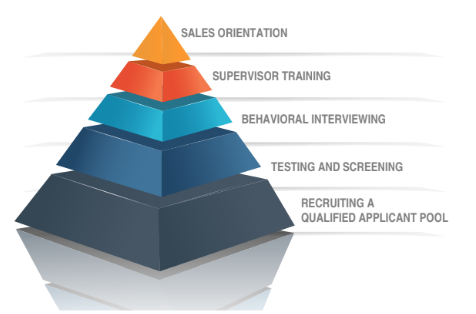

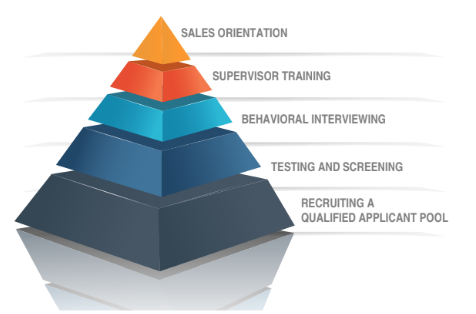

That’s why Schneider Sales Management has developed a five dimensional hiring process. It works like a funnel that starts with the hiring managers and ends with satisfied, productive employees who meet (or beat!) sales performance standards.

Starting at the bottom of the funnel and working up, the first stage of the five dimensional hiring process is continuous talent recruiting. To be successful at strengthening the sales staff, hiring managers need to recruit continuously, tailor their recruiting to target applicants (or, “fish where the fish are,” as the old adage goes), and build the applicant pool by selling the opportunity of working at your organization.

In the testing and screening stage of this process, hiring managers need to find the right tools to prescreen applicants quickly for fit to their sales roles, and find effective ways to maximize the impact of the first in-person interview. Once candidates have been tested and screened, they can be interviewed based on their personality traits and behaviors.

These behavioral interviews will focus interviews on required behavior and results and adhere to a structured interview guide. The interviewees’ answers during behavioral interviews should be compared to and measured against the job requirements, not to other candidates’ responses. There is a right and wrong way to interview, so make sure you’re adhering to legal standards during each candidate conversation.

After the selection process comes two of the most vital stages—stages that many financial institutions mistakenly consider separate from the hiring process.

Each new hire needs a strong sales orientation program and a conditional job offer with an onboarding plan in place. It’s important to outline expectations for new salespeople early on to avoid any confusion about the job role and to get them out of the starting blocks strong.

These tools together create hiring that can give banks and credit unions the quantum leap in performance that they need. Hiring mistakes are too expensive to make, and changing your hiring behaviors is an investment that your organization can make to improve your overall culture and revenue.

We’re the only firm in the industry that can help you put in place a process with these five dimensions. For more information on our support for hiring and HR managers, call us today at 303-221-4511.

by Mike Shallanberger | Dec 19, 2018

Will AI, in-branch, and self-help technology replace salespeople at banks and credit unions? The simple answer is NO according to a gathering of banking and tech thought leaders at the recent Future Branches conference in Austin, TX. But it will change how branch sales roles function, and add some key competencies required for salespeople.

While technology helps tremendously with understanding customer behavior, prospecting, and creating great customer journeys, there will always be a need for salespeople who can form and maintain relationships as a trusted advisor. No technology can build trust the way a great salesperson with keen emotional intelligence can. People are also needed to handle the sale of complex products, and to sell the benefits of new technology in order to drive adoption.

An article in the Harvard Business Journal suggests that, “Humans will need to focus on managing exceptions, tolerating ambiguity, using judgment, shaping the strategies and questions that machines will help enable and answer, and managing an increasingly complex web of relationships with employees and customers.”

For deeper conversations about how your bank or credit union hiring and sales practices may change as technology changes, sign up for the Schneider Report now.

by James Schneider | Dec 19, 2018

Can introverts be effective salespeople at banks or credit unions? The cost of one bad sales hire for a financial institution can be astronomical, so in order to avoid a mistake, many hiring managers look for the classic “sales personality.” Many people associate extroverted behavior and a “big” personality with success as a salesperson; however, that limiting belief may be doing more harm than good to your salesforce.

The truth is that introverts can make excellent salespeople. While extraverts get more energy from being around people, introverts can get more energy from quiet time on their own. While extroverts may talk more and seek out others often, introverts can often spend more time thinking and contemplating before acting. This means that introverts may be perfectly suited for a longer sales-cycle product in a complex selling role like a Commercial Loan Officer, Wealth Management Advisor, or Private Banker.

It’s actually rare that a person is a complete extrovert or introvert. Most people fall somewhere in the middle of what is commonly referred to as the “energy spectrum.” People in a complex selling role need the skills of self-control, organization, patient listening, and empathy commonly associated with introverts. Meanwhile, extraverts in these sales job roles may suffer if they have too high of a drive to persuade or too much sociability that could distract them.

The bottom line is that there is no such thing as one successful “sales personality.” Instead, a person’s individual behavioral traits and competencies must be appropriately matched to a sales role if a hiring manager wants to be successful in interviewing and filling a job opening at a bank or credit union.

The Optimum Performance Profile™ hiring tool screens candidates for the behavioral competencies that drive success in each selling role, and it delivers a score that compares a sales candidate to the top performers in a specific selling role. See an example of an OPP report to see how much data this assessment provides, as well as the interview questions towards the end of the report, which can guide the hiring manager’s interview to explore a potential mismatch before an expensive hiring mistake is made.

by James Schneider | Dec 13, 2018

The moment when a hiring manager shakes the hand of a new hire and welcomes him or her to the team is a hopeful one on both sides of the agreement. Salespeople begin with great hope that they’ll have the staff support and goal structure to help customers and the ability to earn a living while they’re at it. Hiring managers hope that the hire will be a good fit— that they won’t have to interview again for the same role due to employee turnover.

Salespeople who join an organization may not succeed for several reasons. The failure to succeed in selling may show up in sales conversations — the salesperson could “dump” product features on customers, give price or product details too early in the sale, or end conversations with no next step commitment. This ends up in low conversion rates, low performance, and low sales numbers.

One of the main reasons that salespeople fail is because they have been hired for a sales role for which they are not the right fit. We know that different selling roles require different competencies. The industry research we conducted with the University of Colorado at Denver Business School proves that there are actually five primary selling roles in banks and credit unions, each requiring a different set of competencies that drive high performance.

The five roles are SERVICE SELLING (think “teller”), CONSULTATIVE SELLING (think “personal banker”), COMPETITIVE SELLING (think “commissioned mortgage originator” or “business development officer”), COMPLEX SELLING (think “commercial lender”), and SALES SUPERVISION (think “branch manager” or “sales manager”).

Two additional roles, FRONTLINE SUPERVISION (think “teller supervisor”) and ENGAGEMENT SELLING (think “universal banker”) are subsets of these primary roles.

For hiring managers, it’s vital to get an assessment that can evaluate the strengths and weaknesses of each candidate for the specific type of selling that they’ll be doing every day. These hiring managers need to look at sales capability as a series of skills that can be improved, not a natural-born talent or personality fit.

The most important first step for financial industry hiring managers is to screen candidates using the Optimum Performance Profile™ sales assessment. This cutting-edge hiring tool is based on the results of our industry research, and it can predict a salesperson’s performance with a much higher degree of accuracy than a standard interview.

Learn more about these assessments today to improve the success rates of your bank or credit union’s new hires, and get in touch for a free trial so you can increase revenue in 2019.

by Mike Shallanberger | Dec 10, 2018

Coaching is just about every banker’s favorite buzzword. The problem is no one is actually doing it.

Sure, most managers check off their brief conversations with employees about “getting their numbers up” as a coaching conversation, but only a small fraction of bank managers are actually having conversations with their employees to give them specific guidance on how to get better at selling.

And who gets coached the least? Typically it’s new employees and top producers, the employees who want coaching the most and who will give you the best return on your investment in terms of increased sales production.

So what makes a great sales coach?

An average sales coach may occasionally conduct observation coaching with managers, but those sessions are often not specific and unfocused.

A great sales coach will record his or her observations of each employee’s use of preferred selling behavior on an observation notes form and give employees constructive, documented feedback based on those observations.

An average sales coach will use generalizations when categorizing sales behavior. A great sales coach will state his or her expectations for sales production, sales activity, and non-negotiable behavior to his or her direct reports in ways that the staff can restate clearly to others.

An average sales coach might hold sales meetings to develop employee skills in describing products’ features —but a great sales coach will create a peer coaching system that supports the company’s values and preferred way of selling.

Demonstrating preferred sales behavior is also a high priority of great sales coaches. Specific goals for sales managers like “Reduce my average time of talking per customer sales interview from 70% to 30%,” or “Make at least one statement of clear difference during every customer sales interview,” can help set the tone for each sales and service employee – and the sales culture in general.

Get your sales culture strong in 2019. Contact Schneider Sales Management, Inc. today for a consultation and conversation about how we can help you increase your revenue and improve your return on investment for each and every employee in your company. 303-221-4511

by James Schneider | Nov 13, 2018

The Wells Fargo “quota-gate” incident has exposed as myth many of the financial industry’s long held beliefs about what makes a great sales organization. Even the best sales practices become unethical when they encourage greed rather than customer satisfaction.

The unethical sales practices at Wells Fargo come as no surprise to those of us who follow bank sales practices closely. Wells has been recording industry best cross-sell ratios while churning customers and employees for several decades through relentless product pushing. If you ask many bank or credit union executives about their sales culture, their first response is usually, “We don’t want to be a Wells Fargo.”

The knee-jerk reaction to this news may be to pull back from selling and setting sales goals altogether. That would be a mistake. The Hay Group has found that the nation’s most admired companies actually set more challenging goals for employees than other companies.

The good news is that it’s entirely possible to have strong sales proficiency with ethical sales behavior. Our philosophy has always been to focus on the customer, rather than on the products, to help your customers and to increase sales. Here’s a good place to start.

At Schneider Sales Management, every sales manager and employee in a sales or service role is held to a shared Selling Creed of Ethics. This shared system of values guides each decision made from the top down when it comes to hiring, training, coaching, and evaluating sales behavior.

Our Personal Selling Code of Ethics

We do whatever it takes inside or outside the formal boundaries of our solutions yet within the legal constraints of our business to help our customers with our selling so the value they receive far exceeds what they pay.

We treat every customer with respect so he/she feels important, comfortable and understood, even adapting our behavior as necessary to maximize our rapport and mutual trust.

We do what’s right for our customers and for our organization, even if that results in the loss of an immediate sale.

We do our homework, listen carefully as customers speak, and ask the right questions to fully understand a customer’s situation and objectives before recommending solutions.

We’re proactive in seeking information, in offering new insight into the impact of each customer’s current way of doing things, in making recommendations and referrals, and in urging customers to move forward with good ideas to help them improve their current personal or business situation.

We never use high pressure selling tactics as a substitute for coaching customers to their own decisions with questions.

We conduct selling with integrity and high ethics by not misleading customers, by complying with all legal and company requirements for selling, and by not overpromising what we can do for customers.

We give as much importance to what happens after a sale to assure customer satisfaction as we do to what happens during the sales process.

We commit ourselves to continuous, disciplined learning of the core competencies required for our selling role so we remain competent and trusted advisors to our customers.

We outwork our competitors and we work smart in allocating our sales time to our established priorities.

If your financial institution isn’t living up to these standards, it’s time to reexamine your sales process from the top down. Schneider Sales Management provides audits and shops as part of our consulting services. Call us today at (303) 221-4511 and get on track for a better 2019.