by James Schneider | Feb 21, 2019

In the financial industry, different job roles require different core competencies.

For each job role, some core competencies are more important that others, and your evaluation of candidates should give extra attention to assessing those few critical attributes. Some attributes are nice to have, but the core competencies should be considered “must have.” Don’t overvalue one competency at the expense of others. Star performers typically have strengths across a range of competencies for their optimum selling role.

Competencies are the skills, abilities and motivations that actually cause effective and/or superior performance in a job role. A characteristic is not a competency unless there is evidence that indicates that possession of the characteristic precedes and leads to effective and/or superior performance in a job as measured on a specific criterion or standard.

Distinguishing competencies are those skills or abilities that differentiate superior performance from average or poor performance such as a salesperson setting goals higher than the goals required by the organization.

Here are some of the core competencies and sample job roles for each type of selling. Take a look and see if you’re valuing the competencies for each role that are going to make the biggest difference for your bottom-line revenue.

Service Selling

Core competencies:

Achievement Drive, Initiative, Energy, Organization Skills, Sociability, Empathy

Sample job roles:

• Teller

• Receptionist/Greeter

• Contact Center Rep (In-bound service)

• Loan Processor

Consultative Selling

Core competencies: Achievement Drive, Optimism, Adaptability, Social Leadership, Creative Quick Thinking, Organization Skills

Sample job roles:

• Personal Banker/Universal Banker

• Customer Service Rep.

• Member Service Advisor/Personal Banker

• Contact Center Rep (In-bound sales)

• Consumer Loan Officer

• Internal Mortgage Originator

• Insurance Consultant

• Investment Officer

Competitive Selling

Core competencies: Achievement Drive, Drive to Persuade, Optimism, Resilience Energy, Organizational Skills

Sample job roles:

• Business Development Officer

• Small Business Banking Officer

• Trust Officer–Employee Benefits

• External Mortgage Originator

• Wholesale Mortgage Lender

• Contact Center Rep (Outbound Sales)

Complex Selling

Core competencies: Achievement Drive, Empathy, Self-Control, Planning & Analytical Thinking, Social Leadership, Organization

Sample job roles:

• Commercial Loan Officer

• Trust BDO/Administrator

• Wealth Management Advisor

• Private Banker

• Cash Management Officer

Sales Supervision

Core competencies: Achievement Drive, Empathy, Developing Others, Optimism, Collaboration, Planning & Analytical Thinking

Sample job roles:

• Business Unit Manager

• Regional Manager

• Branch Manager

• Sales Manager

• Assistant Branch Manager

• Operations Supervisor

• Contact Center Supervisor

by James Schneider | Jan 23, 2019

Most sales leaders treat all people and all selling situations as if they were the same. They’re not. A 7’7″ basketball player like former NBA player Manute Bol may not be very skilled at shooting and dribbling, but he may be the player on the team best fit to rebound and to block shots. Similarly, an employee may not have the patience, empathy and planning skills to succeed at long cycle selling, but he may be our company’s best salesperson at prospecting and closing short cycle transactional sales.

National research of high performing salespeople in the financial services industry by Schneider Sales Management, Inc. has proven that almost all sales positions and all distinguishing sets of sales competencies can be described by five selling roles based on the behavioral requirements for success in the job. These roles are appropriate for all financial institutions based on the behavior competencies required to perform each role.

All top producing salespeople have some crucial competencies in common, such as strong achievement drive, but each selling role requires some competencies that are different than those required for other selling roles.

If you are a hiring manager or a sales manager, it is your responsibility within your bank or credit union to define clearly what each employee’s role in selling is, and to fit the right people to the right role to build a successful team.

Choosing the right sales practices, the right performance metrics and the right coaching priorities is easy once you’ve defined each employee’s role in selling.

Here is more information on each of the five main financial industry selling roles in banks and credit unions.

Service: Job requires servicing customer transactions and maintaining friendly customer relations, and may require conducting some referral or suggestive selling.

Consultative Selling: Job requires completing sales and service transactions, advising customers on product selection or use, closing first sales quickly, making add-on or follow-up sales, and managing selected customer relationships in primarily in-store, customer-initiated conversations. In blended sales and service positions the job may also require proactive outreach to approach and engage in-store customers to create sales opportunities.

Competitive Selling: Job requires continuous prospecting, competing for sales persistently despite high rejection rates, conducting minimal after-sale servicing, and closing competitive sales in one or two interviews using emotional pressure.

Complex Selling: Job requires closing large, complex or technical sales over a long selling cycle, analyzing prospect problems and product applications to propose customized solutions, networking socially for new business, and retaining and developing customer relationships over time.

Sales Supervision: Job primarily requires direct supervision and coaching of sales personnel and/or their supervisors, and typically requires some personal selling. In senior level positions the job also requires sales planning.

by James Schneider | Jan 19, 2019

For many banks, universal banker has delivered on the promise of cost savings, seamless service, and recognition of more sales opportunities. Most banks, however, have had poor results. Here’s why.

To save money, most banks simply promote their existing teller staff to the much more proactive universal banker role and eliminate entirely the role of personal bankers who provide in-depth sales advice and make outbound calls. They install performance metrics and compensation that rewards efficiency over sales productivity. Little or no training is done to teach universal bankers how to approach customers and convert assisted transactions into sit-down appointments.

And then we wonder why another interesting innovation in customer experience fails. For advice on how to maximize sales from your universal banker team, call us at (303) 221-4511.

by Mike Shallanberger | Jan 15, 2019

“I view my primary job as strengthening our talent pool.” — Jack Welch

No amount of coaching can offset poor hiring decisions, and the cost of a bad hire is estimated conservatively to be at least two or three times an employee’s annual salary plus thousands of dollars in lost opportunity cost for sales not made and for customers lost. The society for Human Resource Management (SHRM) estimates a hiring mistake could even cost as much as five times the employee’s annual salary.

The new reality in our industry is that we now have to get more sales from fewer people. It’s particularly crucial that you identify strategically critical jobs, and then invest your time and resources disproportionately to ensure that the right people, doing the right things, are in these positions. The more complex the sales or sales leadership task is, the bigger the performance gap between top and low performers.

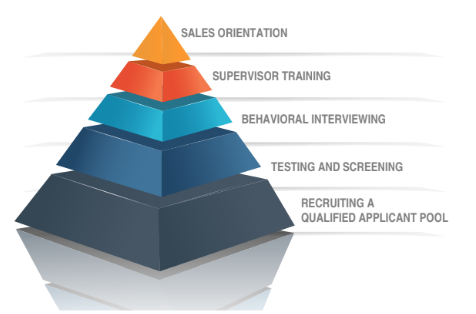

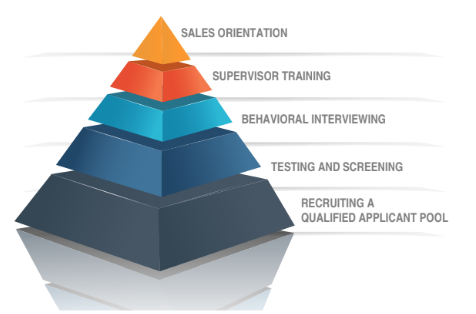

That’s why Schneider Sales Management has developed a five dimensional hiring process. It works like a funnel that starts with the hiring managers and ends with satisfied, productive employees who meet (or beat!) sales performance standards.

Starting at the bottom of the funnel and working up, the first stage of the five dimensional hiring process is continuous talent recruiting. To be successful at strengthening the sales staff, hiring managers need to recruit continuously, tailor their recruiting to target applicants (or, “fish where the fish are,” as the old adage goes), and build the applicant pool by selling the opportunity of working at your organization.

In the testing and screening stage of this process, hiring managers need to find the right tools to prescreen applicants quickly for fit to their sales roles, and find effective ways to maximize the impact of the first in-person interview. Once candidates have been tested and screened, they can be interviewed based on their personality traits and behaviors.

These behavioral interviews will focus interviews on required behavior and results and adhere to a structured interview guide. The interviewees’ answers during behavioral interviews should be compared to and measured against the job requirements, not to other candidates’ responses. There is a right and wrong way to interview, so make sure you’re adhering to legal standards during each candidate conversation.

After the selection process comes two of the most vital stages—stages that many financial institutions mistakenly consider separate from the hiring process.

Each new hire needs a strong sales orientation program and a conditional job offer with an onboarding plan in place. It’s important to outline expectations for new salespeople early on to avoid any confusion about the job role and to get them out of the starting blocks strong.

These tools together create hiring that can give banks and credit unions the quantum leap in performance that they need. Hiring mistakes are too expensive to make, and changing your hiring behaviors is an investment that your organization can make to improve your overall culture and revenue.

We’re the only firm in the industry that can help you put in place a process with these five dimensions. For more information on our support for hiring and HR managers, call us today at 303-221-4511.

by Mike Shallanberger | Dec 19, 2018

Will AI, in-branch, and self-help technology replace salespeople at banks and credit unions? The simple answer is NO according to a gathering of banking and tech thought leaders at the recent Future Branches conference in Austin, TX. But it will change how branch sales roles function, and add some key competencies required for salespeople.

While technology helps tremendously with understanding customer behavior, prospecting, and creating great customer journeys, there will always be a need for salespeople who can form and maintain relationships as a trusted advisor. No technology can build trust the way a great salesperson with keen emotional intelligence can. People are also needed to handle the sale of complex products, and to sell the benefits of new technology in order to drive adoption.

An article in the Harvard Business Journal suggests that, “Humans will need to focus on managing exceptions, tolerating ambiguity, using judgment, shaping the strategies and questions that machines will help enable and answer, and managing an increasingly complex web of relationships with employees and customers.”

For deeper conversations about how your bank or credit union hiring and sales practices may change as technology changes, sign up for the Schneider Report now.

by James Schneider | Dec 19, 2018

Can introverts be effective salespeople at banks or credit unions? The cost of one bad sales hire for a financial institution can be astronomical, so in order to avoid a mistake, many hiring managers look for the classic “sales personality.” Many people associate extroverted behavior and a “big” personality with success as a salesperson; however, that limiting belief may be doing more harm than good to your salesforce.

The truth is that introverts can make excellent salespeople. While extraverts get more energy from being around people, introverts can get more energy from quiet time on their own. While extroverts may talk more and seek out others often, introverts can often spend more time thinking and contemplating before acting. This means that introverts may be perfectly suited for a longer sales-cycle product in a complex selling role like a Commercial Loan Officer, Wealth Management Advisor, or Private Banker.

It’s actually rare that a person is a complete extrovert or introvert. Most people fall somewhere in the middle of what is commonly referred to as the “energy spectrum.” People in a complex selling role need the skills of self-control, organization, patient listening, and empathy commonly associated with introverts. Meanwhile, extraverts in these sales job roles may suffer if they have too high of a drive to persuade or too much sociability that could distract them.

The bottom line is that there is no such thing as one successful “sales personality.” Instead, a person’s individual behavioral traits and competencies must be appropriately matched to a sales role if a hiring manager wants to be successful in interviewing and filling a job opening at a bank or credit union.

The Optimum Performance Profile™ hiring tool screens candidates for the behavioral competencies that drive success in each selling role, and it delivers a score that compares a sales candidate to the top performers in a specific selling role. See an example of an OPP report to see how much data this assessment provides, as well as the interview questions towards the end of the report, which can guide the hiring manager’s interview to explore a potential mismatch before an expensive hiring mistake is made.